W9 Form Fill Online

This is the most reliable and convenient way to fill out the W9 form without mistakes

For the price of two cups of coffee!

Quick and easy

The average filling out takes only 3 minutes.

For the price of couple cups of coffee

We make a complex form easy to fill out

Simple process

You just need to answer a few questions.

Completely safe

Your personal information is deleted as soon as the form letter is sent to you.

How it works - 3 easy steps

At W9form.Us, we wanted to make W-9 form as easy as possible by using our platform. We get to the meat of what the form is asking. Instead of looking at long instructions, users look at a survey they can quickly go through. After they submit their answers, we map their replies to the corresponding fields.

Take our people-friendly survey

Our guided process helps users looking to create a W-9 navigate the complex IRS regulations in a way that a paper W-9 can’t. The entire process has been created to help users create a correct, complete and signed W-9.

Payment and user agreement

By submitting your data through our website, you agree to the user agreement. By sending your personal data, you can be sure of their safety, because we use triple encryption, so your data under no circumstances will fall into third parties.

All done! Check your Email!

Now you have an absolutely correct completed form. You can use it and not worry about any penalties

What is a W-9 and how is it used

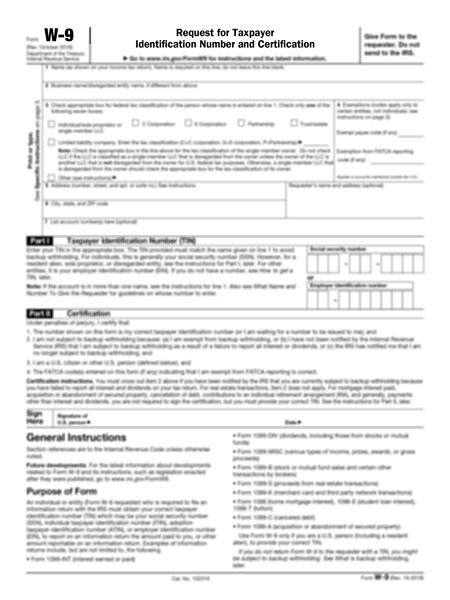

A W-9 form, or Request for Taxpayer Identification Number and Certification, is a form used by businesses to request the taxpayer identification number (TIN) and other information from people who are not their employees. The TIN is used by the IRS to identify taxpayers and track their income.

The W-9 form is most commonly used by businesses to collect information from independent contractors, freelancers, and other non-employees who are paid more than $600 in a year. The information collected on the W-9 form is used by the business to file Form 1099-MISC, which reports payments made to non-employees.

The W-9 form can also be used by businesses to collect information from other types of non-employees, such as vendors, landlords, and attorneys.

To complete a W-9 form, you will need to provide your name, address, TIN, and signature. You will also need to certify that you are not subject to backup withholding.

Backup withholding is a process by which the IRS withholds 28% of your payments if you do not provide your TIN to the payer.

If you are required to complete a W-9 form, you should do so promptly. Failure to complete a W-9 form may result in the payer being required to withhold backup withholding from your payments.

Here are some of the situations where you may be required to complete a W-9 form:

- You are an independent contractor or freelancer who is paid more than $600 in a year.

- You are a vendor who provides goods or services to a business.

- You are a landlord who rents property to a business.

- You are an attorney who provides legal services to a business.

If you are unsure whether you are required to complete a W-9 form, you should contact the payer.

Gerry Fredrick

Dan Richter

Liza

Kamil Svicarevich

Fernando Slade